Which would you rather know: how many clicks your ad is getting, or how many leads your ad is generating?

Most business owners would say the second. After all, leads and sales are often the reason for running a pay-per-click campaign in the first place.

Why, then, are so many pay-per-click agencies reporting on empty metrics like clicks, impressions, and cost-per-click?

Calculating the real impact of an ad or campaign on your bottom line is actually fairly simple if you have the raw data on hand. Here’s how.

Two little metrics that make a big difference

Clicks, impressions, and cost-per-click data can signal whether or not your campaigns are on the right track. But to know whether or not your campaigns are successfully producing ROI, you must know the cost-per-lead (CPL) and cost-per-acquisition (CPA).

Cost-per-lead measures the average cost of getting a reader to contact you and become a lead. They might be someone who fills out a form, or who calls you from a phone number on your Google ad.

Once you know your cost-per-lead, you know how much your company needs to spend to generate new business leads.

Then, cost-per-acquisition takes cost-per-lead one step further and calculates how much you need to spend to acquire a customer. In the PPC world, an “acquisition” happens when a user who clicked on your ad makes a purchase or engages in working with you.

Cost-per-lead formula

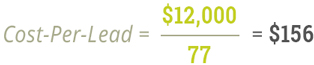

The cost-per-lead formula looks like this:

Let’s say you run a home remodeling business and you decide to use a PPC campaign to generate leads.

If you invested $12,000 in a PPC campaign that generated 77 leads, then your cost-per-lead is $156. If the average revenue for your services is $150, that cost-per-lead is too expensive.

Your cost-per-lead is calculated using the formula above:

For businesses whose remodel projects have a higher price point, investing $156 to attract a warm lead may be reasonable because it could generate thousands of dollars in revenue.

Cost-per-acquisition formula

Cost-per-acquisition is the gold standard in PPC metrics because it actually tells a complete story. It measures the average cost of acquiring a revenue-generating customer.

The cost-per-acquisition formula is:

Using the home remodeling example above, let’s say that out of the 77 leads you attracted, 10 decided to purchase from you.

Your cost-per-acquisition is $1,200. Again, depending on your business, that number could be a smart investment or an unprofitable one.

How do you know if it’s smart or unprofitable? Luckily, there’s a formula for that, too.

Are you paying too much for your customers?

Find out in two simple steps.

Step 1: Determine your customer lifetime value

To understand your ideal CPA, you have to first understand how much the average customer is worth to your business, or their “lifetime value.” If you were to attract a new customer today, how much money would that person spend over the course of their entire relationship with you?

The customer lifetime value formula looks like this:

Let’s add some more numbers to our home remodeling example.

After material and labor costs, your business makes an average of $9,000 on each sale. Your customers tend to do one big project during Year 1 and return to you for another project in Year 2.

The lifetime value of your customer is $18,000. Not bad!

Step 2: Name your cost-per-acquisition threshold

How much are you willing to pay for a customer? The answer is different for every business, and it depends on your margins and lifetime value.

Returning to the remodeling example, if the customer lifetime value is $18,000 and your margins are historically 20% ($3,600), you may not want to pay more than 5% of the customer value ($900) for acquisition.

Otherwise, your margins might be too low.

We identified earlier that your CPA is $1,200, which is 6.6% of your customer lifetime value and margin. That may or may not be a good deal for you.

Before embarking on a PPC campaign, determine your CPL and CPA thresholds. You obviously want the lead cost to be lower, but you’ll know that if you cross the threshold you’re in dangerous territory.

Be sure to share the metrics with your PPC agency too. It’ll help optimize your campaign when they have goals.

When it comes to PPC metrics, focus on value over vanity

Does your PPC agency report on meaningful data like CPL and CPA, or are your reports filled with “vanity” metrics that may look good but don’t tell the whole story?

Let ParaCore show you how we do things differently. Schedule a free consultation!

Related Posts

- What Is The Difference Between PPC and SEM?

- PC Audit Handbook: How to Analyze Your PPC Campaigns

- The Best PPC Tools of 2022, As Told by PPC Experts

- Beginner’s Guide to UTM Tags & Tracking

- Generate Leads with Facebook Lead Ads

- How Does Pay Per Click Work?

- Benefits of PPC

- Why Should I Invest in PPC?

- What is Google PPC Advertising?

- Facebook Retargeting Strategy

- Introduction to ManyChat

- Case Study: Return on Ad Spend Optimization

- 🎁🎄 Holiday Ad Spend Strategy

- Should You Be Running Branded Ads?

- SEO vs SEM

- CTAs for YouTube Ads

- Case Study: 258% Increase in Conversions

- Traffic Campaign Strategy

- No Captions on Facebook Ads or YouTube? You’re Killing Performance

- LinkedIn InMail Website Re-targeting

- Yes. You can have access to your ad account. No, it’s not “impossible”

Previous Video

Previous VideoFacebook Business Manager Overview